There are several different types of commercial real estate leases, and each has its own attributes regarding rent, fees, and other expense arrangements. Today we will look at a few of these commercial real estate lease types to give you a better idea of who pays rent and insurance and what other responsibilities belong to who.

Gross Lease Type

With this lease on commercial property, there is a tenant that pays the rent. The landlord is responsible for the taxes, insurance, utilities, and overall maintenance of the building. It is also known as a full-service lease because all of the operating expenses fall to the landlord.

Modified Gross Lease Type

In this lease, the tenant not only pays the rent but is also responsible for the utilities and maintenance of each individual unit. The landlord is still responsible for the taxes and insurance as well as the utilities and maintenance of any common areas there are in the building.

Net Lease Type

With a net lease, the tenant of the commercial property in pays the rent, the utilities, and a fixed portion of the operating expenses. The landlord's financial responsibility varies depending on the type of net lease it is. There are four types of net leases. These include single, double, triple, and absolute.

- Single: tenant pays rent and a share of the taxes along with utility costs, maintenance and other fees for each individual unit

- Double: Along with rent and a share of the property taxes, a tenant must also pay a portion of the insurance premiums for the property

- Triple: This is the most common and widely used net lease option and states that the tenant pays rent, a share of the property taxes, a portion of the insurance, and a fixed fee for maintenance for common areas

- Absolute: This is also known as an absolute triple net lease and states that the building's financial responsibilities lie on the tenant including the taxes, maintenance, any repairs, insurance, and other fees and operating expenses. This would give the tenant more control as well as full liability if something were to happen

Percentage Lease Type

Under a percentage lease type for a commercial property, the rent and a percentage of the monthly sales are paid by the tenant. At the same time, taxes, insurance, utilities, and maintenance are taken care of by the landlord.

Choosing the Best Commercial Lease Option

The net lease, again, is the more popular and most commonly used commercial real estate lease type and is typically used for freestanding buildings and retail spaces. Many commercial lease options have a length of between three and five years, but there is always some room for compromise and flexibility between a short or long term lease option.

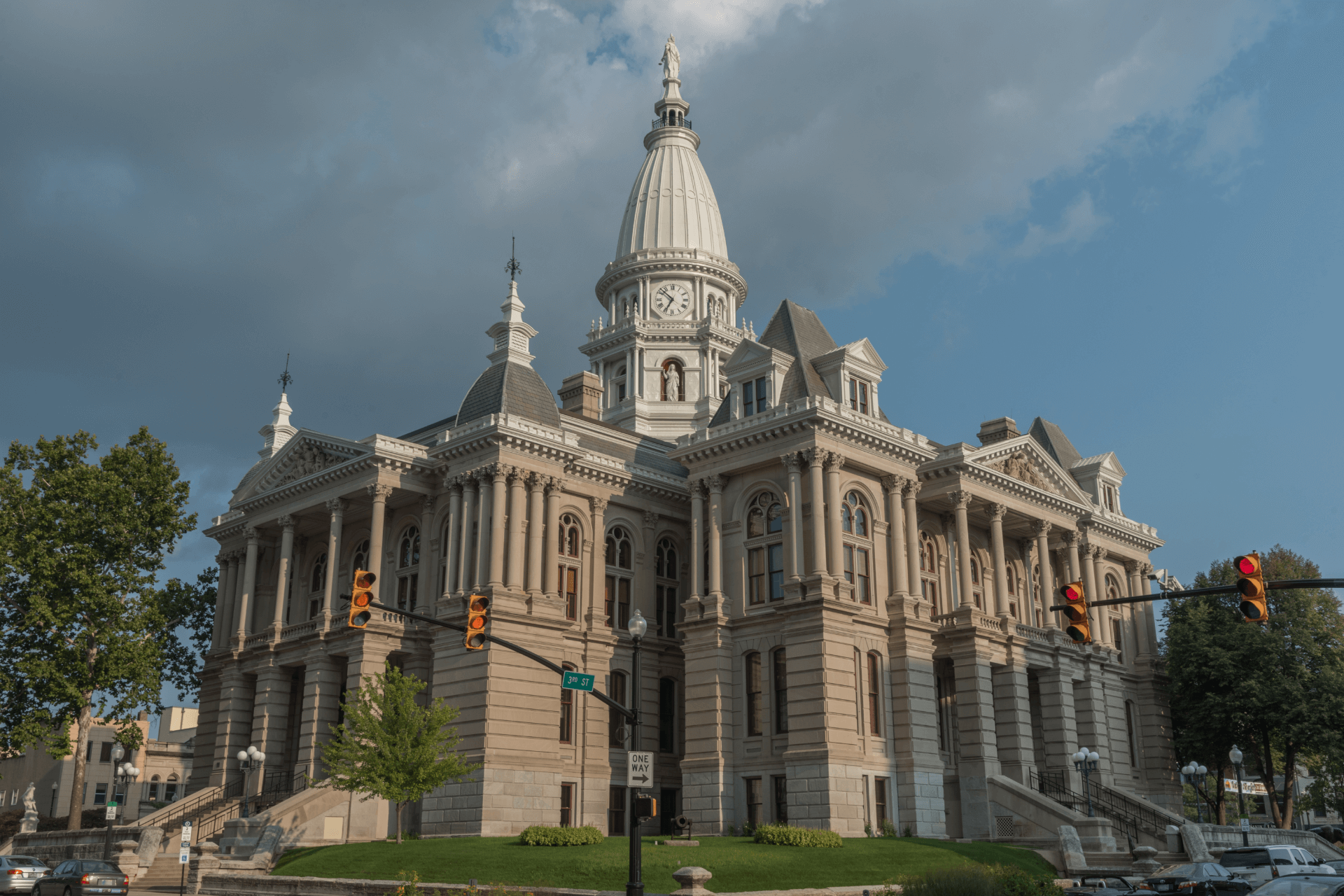

For more information on commercial real estate properties that are available in or to learn a little more about each commercial lease type, contact the real estate experts at Titan Lafayette Real Estate today.