If you own a home and have the pleasure of shopping around for the best home insurance rates, then you may already know that natural disasters aren't typically something covered under a basic home insurance policy. This is especially true if you live in a high-risk area.

For this reason, many insurance companies offer supplemental policies that a homeowner can purchase separately to cover specific types of natural disasters in their area.

There have been some big natural disasters in recent years including all the hurricanes and wildfires. The damages from these natural disasters are still being dealt with and have risen into the billion-dollar range.

This begs the question: how have these natural disasters affected home insurance rates as people work to rebuild and get their lives back together following disaster?

Home Insurance Rate Trends

homeowners in some of the high-risk areas, but not all, may face bigger increases, or they could be faced with having trouble finding insurance at all. With all the disasters and the concerns about climate change, the rates are being put under some immense pressure these days.

Redraw Risk Maps

If there was a big natural disaster in your area and you weren't already considered a high-risk area, then you might end up paying more in rates in the future as they change conditions and redraw the risk maps often used to help determine home insurance rates in a given area.

Flood maps are typically followed by the insurance industry, for example. These flood maps are often government maps, but insurance companies have been known to come up with their own as they redefine what is considered a high-risk area.

If you were previously outside of a flood zone you might now be included in one; this means you will need to purchase supplemental insurance to cover yourself in the case of a disaster. You will also likely find those higher insurance rates due to the newly mapped high-risk area.

Premium Changes and Less Coverage

If you find you are a homeowner facing these premium changes and finding less coverage than before, there are a few things you can do to help yourself.

Read the Fine Print

This is especially important if you find yourself living in a newly defined risk area. Some insurance companies have changed their terms and have moved the risk while passing the increased premiums to the homeowner. Make sure to read all the fine print to make sure you don't miss anything regarding your policy.

Shop Around

It never hurts to shop around and find different rates from various insurance companies. You may be able to find a lower rate and a bit more coverage than you currently have.

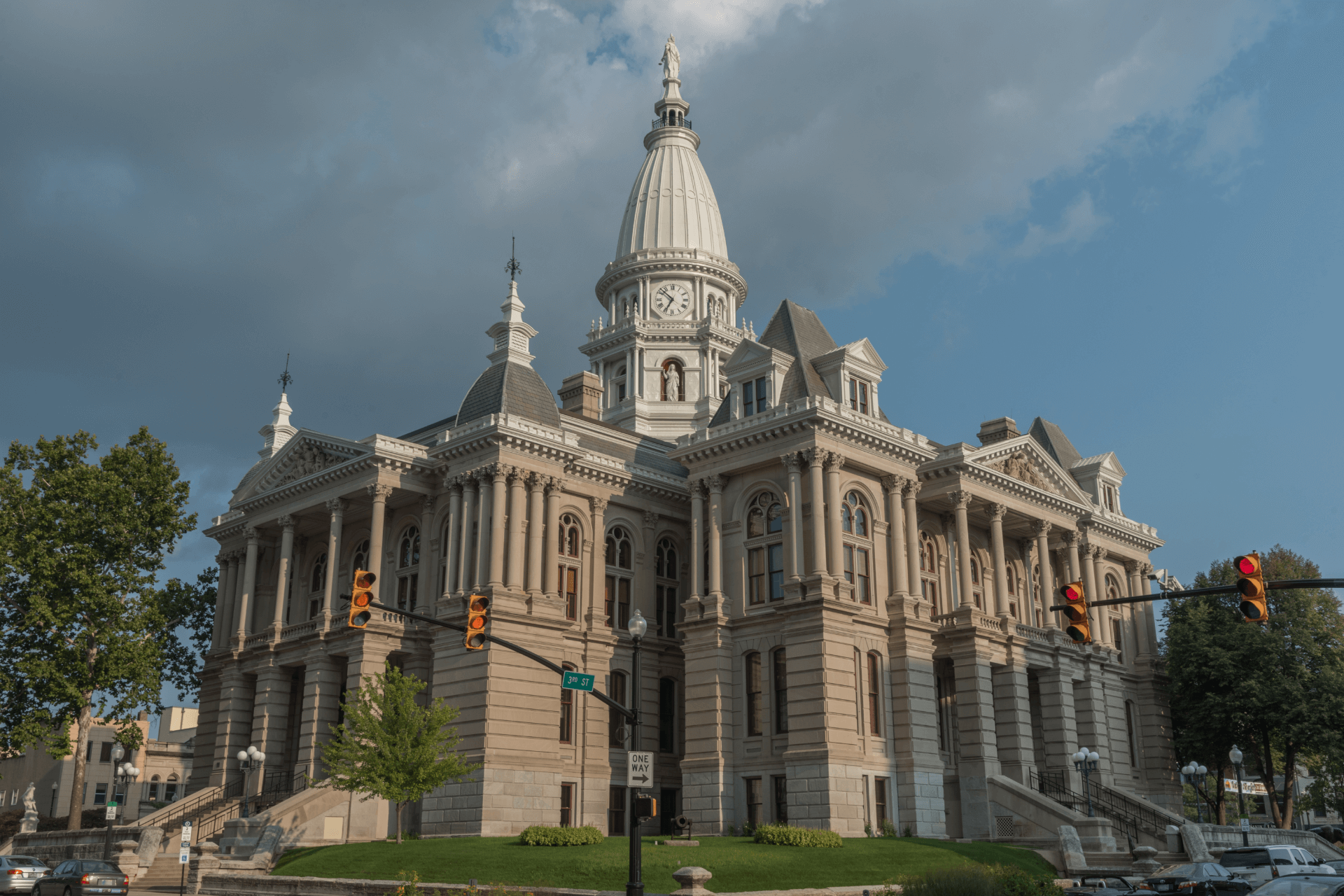

Have more questions about real estate and the rates in particular areas? Contact Titan Lafayette Real Estate for more information on homes in the area and if they are considered high-risk zones.